RRIF The most flexible retirement income

With Beneva you can designate a beneficiary to receive the balance of your account in the event of death.

Financial goals

Retirement income

Horizon

Short term

Or give us a call

1 866 612-3473

The Registered Retirement Income Fund (RRIF) is the logical extension of your RRSP. It allows you to start withdrawing your savings as income when you retire or the year you turn 71. Your years of saving have finally paid off, enjoy!

Why transfer to an RRIF?

Time to reap the rewards of all those years saving.

How does it work? Your RRIF 4-step roadmap

1. It all starts with a plan

If you’re about to turn 71 or want to receive retirement income, that’s your cue to get in touch with one of our advisors!1

The first step is to discuss your retirement plan: the time horizon, your withdrawal plan and your risk profile.

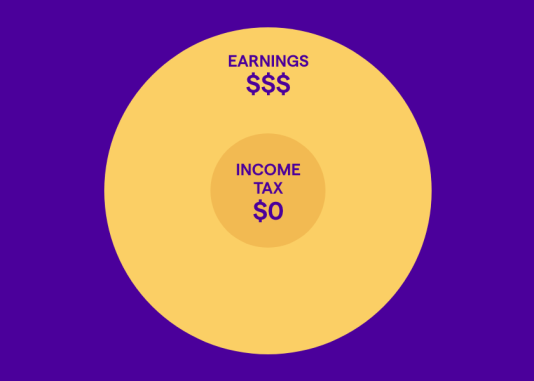

2. Next comes strategy

Even if you can no longer contribute to your RRIF, you can still manage your investments to reflect your needs. Your investments continue to grow tax-sheltered until withdrawn.

You can also transfer your RRSP investments to a RRIF without having to liquidate them.

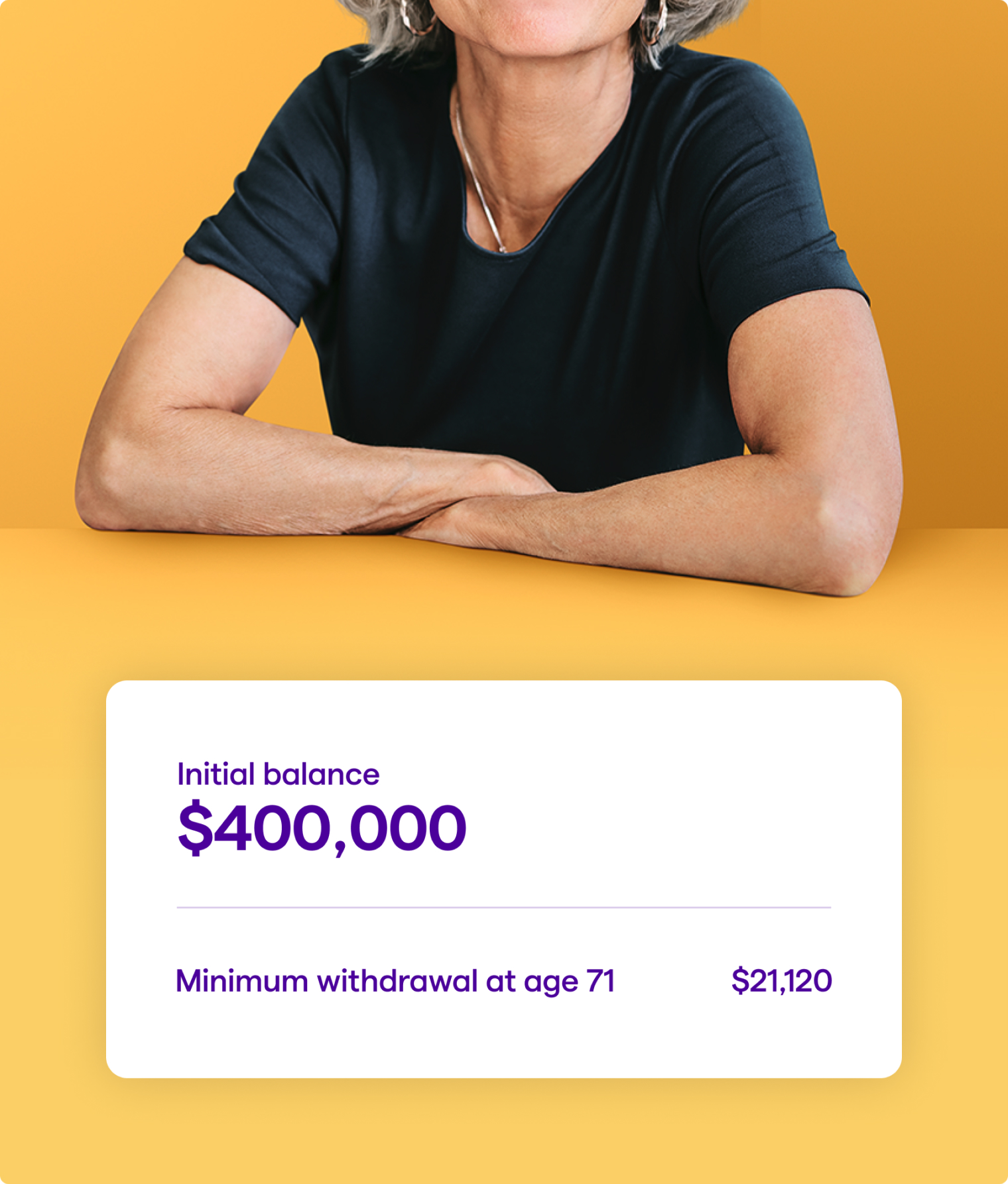

3. Minimum withdrawals each year

The year after you open the RRIF, you start withdrawing at least the legally required minimum, depending on your age.

Unlike the LIF there’s no maximum limit, so you have the freedom to withdraw as much as you need based on your goals and retirement plan.

Just keep in mind that the money you withdraw from your RRIF lowers your reserves and becomes taxable income.

4. Your RRIF can be passed on

If you pass away before your partner, the RRIF can be transferred to your spouse tax-free.

The scenario shown here is for demonstration purposes only2 and should not be relied upon as financial or other advice.

Beneva, a smart investment!

Transfer from RRIF to annuity

Annuities, your go-to for guaranteed income year after year.

Enjoy the flexibility of a Beneva RRIF and convert your savings at any time to a term certain annuity or a life annuity.

Think of the RRIF as an empty box. How you fill it is up to you!

More questions about investment? We’ve got answers.

Take control of your financial future. Sign up for one of our financial security webinars and get clear, useful and practical information to use in your current situation.

These plans might also interest you

1. On behalf of Beneva Inc., Financial services firm and its authorized partners.

2. The risk profile is conservative based on the needs analysis completed by the advisor.1 The scenario is based on a 71- to 95- year time horizon, the 2021 minimum withdrawal, an initial amount of $400,000, the reinvestment of earnings and an annual return of 2%. Amounts are rounded to the nearest thousand.