Why invest with Beneva?

Pro tip for investors:

It's a little-known fact that investing with an insurer brings something extra to the table.

Investing with Beneva: Where do I start? Your investment roadmap

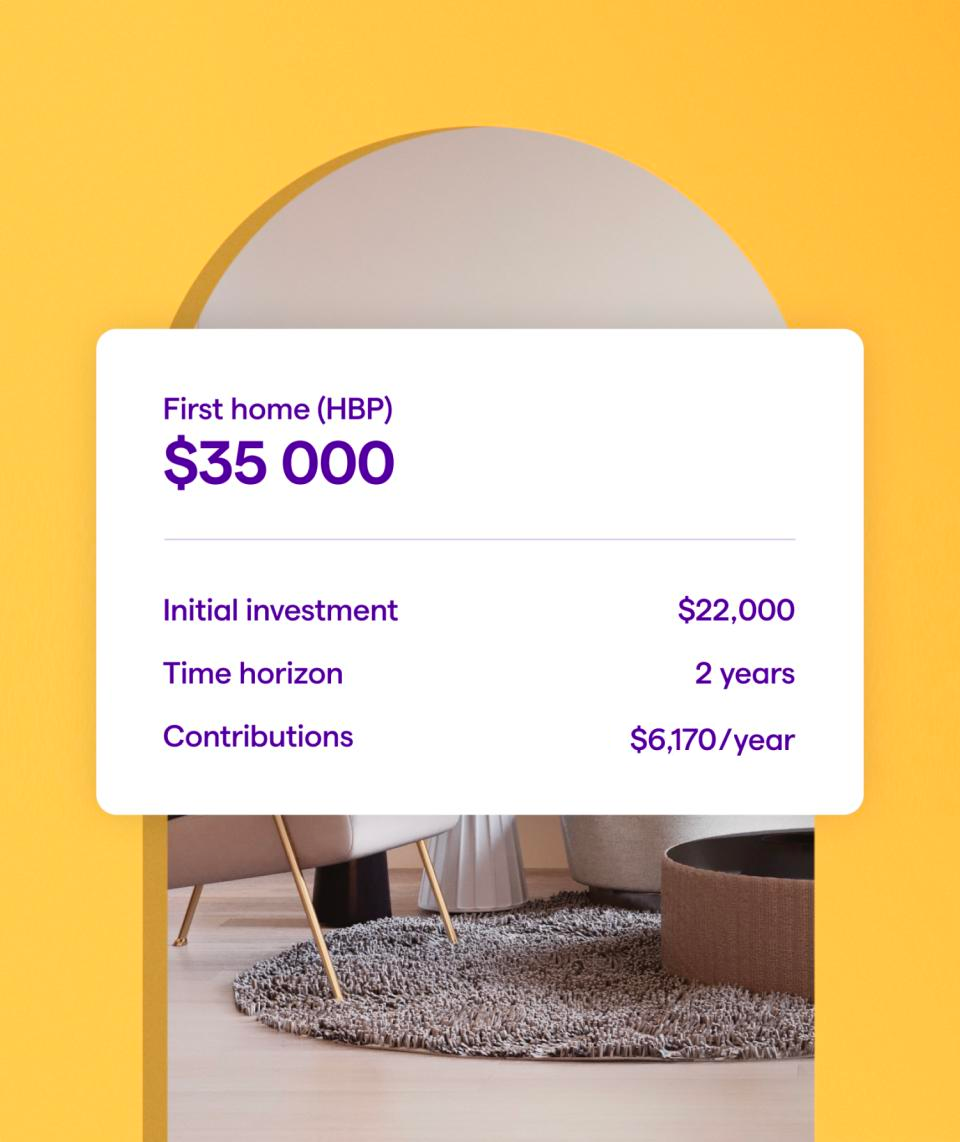

1. It all starts with a plan

Together, we map out your investment plan to reach your goals, whether it’s retirement, the trip of a lifetime… or both! We’ll look at:

- initial investment

- target amount

- target date

- contributions to reach your goal based on your financial situation

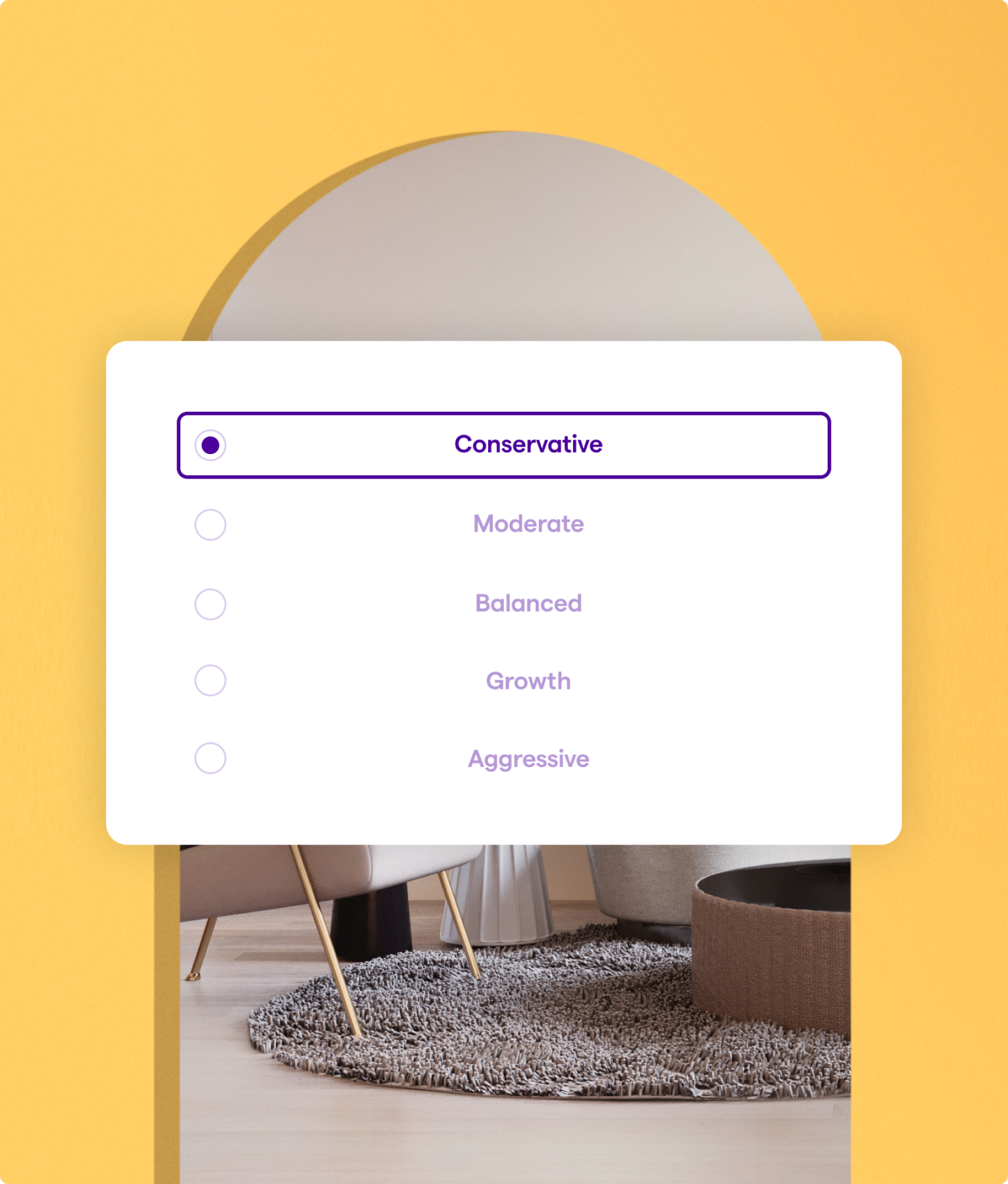

2. Next comes strategy

Now it’s time to choose your plan and investment products. This is the part where we develop a strategy aligned with your goals and really put your money to work.

We’ll determine, among other things, your:

- investor profile

- plan (investment vehicle)

- investment choices

See the different risk profiles

3. Let your money do the work

Stick to your contribution plan, let us know when adjustments are needed… and let your investments do the rest.

4. Reap the rewards!

Cash in when you've reached your goal. Your advisor will walk you through this step and help you steer clear of tax penalties whenever possible!

That’s the great thing about a financial advisor—you get expert help planning your life goals, big and small.1 You’ve worked hard for your money, let it return the favour.

The scenario shown here is for demonstration purposes only and should not be relied upon as financial or other advice.2

Investing in life shouldn’t take a lifetime.

More questions? Sign up for our webinars.

Take control of your financial future. Sign up for one of our financial security webinars and get clear, useful and practical information to use in your current situation.

1. On behalf of Beneva Inc., Financial services firm and its authorized partners.

2. The risk profile is conservative based on the advisor’s needs assessment.1 Scenario based on a 2-year horizon, with the reinvestment of tax refunds and earnings, and an annual return rate of 2 %. Amounts are rounded to the nearest $5.