Insurance documents

Understanding your insurance contract and invoice

Taking out insurance is important, but so is understanding the insurance documents. Invoices, policies, certificates and cards: it can get complicated. We break it all down for you here.

Which document would you like more information on?

My invoice (bill)My insurance certificate and other documents

My invoice (bill)

When you make a change to your insurance (new policy, renewal, modification or cancellation), we'll send you an invoice. It will either be uploaded to the Billing and Payments section in your Client Centre account or mailed to you (based on your preference). If it is mailed, you will receive it separately from your policy.

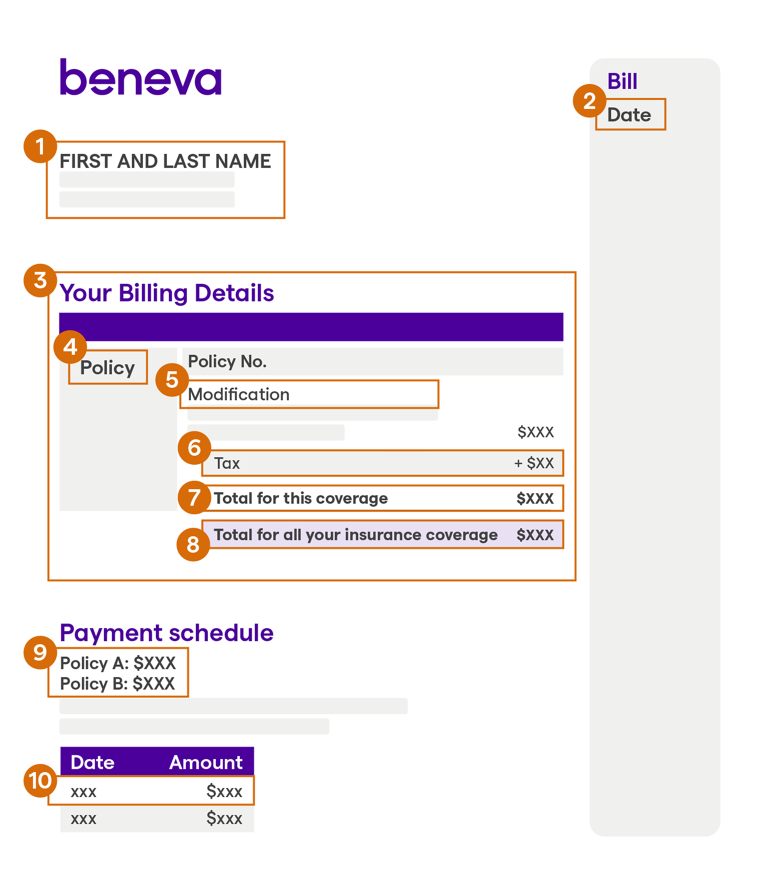

The invoice below is just an example (it may not be identical to yours). It is simply provided to help you understand it better.

- Policyholder’s name: This is the only name that appears on the invoice. Refer to the Declarations section of your contract for the names of all other insured persons.

- Date: Date on which the invoice was issued.

- Your Billing Details: All the policies you hold appear on the invoice. For coverage information, refer to the actual policy.

- Policy: An insurance policy, sometimes referred to as the contract, covers specific property and belongings (e.g. vehicles). Refer to the policy for the details.

- Modification: The type and date of the change (new policy, renewal, modification or cancellation) as well as the duration of the active policy.

- Tax: Only one tax is applied to insurance products, namely the 9% provincial sales tax (PST). The only exception is accident benefits insurance (Q.E.F 34 and 4-34). Following a change, the tax is applied to the remainder of the annual premium.

- Total for this coverage: The total price to pay for a policy. When no changes are pending, the price displayed corresponds to the amount calculated up to the end of the contract.

- Total for all your insurance coverage: The total price to pay for all policies.

- Payments: The total amount of your invoice divided by the number of instalments until the end of the contract.

- Billed amount: The actual amount that will be debited from your account on the specified date. When you have two accounts, each has a calendar. When two policy payments are debited on the same day, they may be combined into one.

My insurance certificate and other documents

Insurance card or certificate, commercial insurance contract, pricing and proof of insurance: learn about all these documents.

My insurance card or certificate

Insurance certificate at beneva.ca:

- Log in to the Client Centre

- Go to the Home, Car and Recreational Vehicles or the Commercial section

Even though your certificate is available in the Client Centre, you will receive a copy by mail.

Insurance card in the Beneva app:

- Open the app and log in

- Select Insurance cards at the bottom of the screen

Your insurance certificate appears below the Declarations section in your contract, which now reflects Beneva’s visual identity.

You can also find it in the Client Centre and print a copy, if needed.

My commercial insurance contract

Contracts have been updated to reflect Beneva’s visual identity. Rest assured that your information is unchanged and secure. Nothing is expected of you. We've taken care of everything.

Yes. Policies and invoices are managed separately. It is therefore possible to receive them at different times, whether by mail or in your Client Centre account.

My home and car insurance pricing

Several factors influence the price of car insurance. For more information, consult the Understanding My Increase page.

Several factors influence the price of home insurance.

Here are a few of them:

Rising cost of building materials

The cost of building materials drives up the cost of home renovations and repairs.

More frequent, serious water damage

Finished, fully furnished basements increase the cost of repairs.

Extreme weather events

Hail, icy rain, strong winds and heavy rain can cause a lot of damage and increase the cost of claims.

Labour shortage

The demand for specialized workers increases the cost of repairs.

My proof of insurance for renting a car

At beneva.ca:

- Log in to the Client Centre

- Go to the Home, Car and Recreational Vehicles or the Commercial section

The Beneva app:

- Open the app and log in

- Select Insurance Cards at the bottom of the screen

Good to know: Your proof of insurance can also be added to your digital wallet (Apple Wallet / Google Wallet) for convenient access when renting a vehicle.

By mail:

You will receive a copy of your proof of insurance by mail, on the same page as your insurance certificate under Q.E.F. No. 27, with Beneva’s look and feel, like the rest of the contract.

Q.E.F. No. 27 is also referred to as Civil liability resulting from damage caused to vehicles of which named insured is not owner.

To receive a copy of Q.E.F. No. 27 by email, fill out a Proof of Insurance Request form.

See example of Q.E.F. No. 27